|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

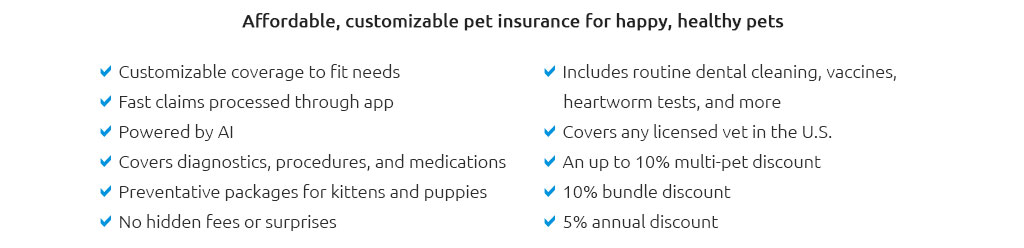

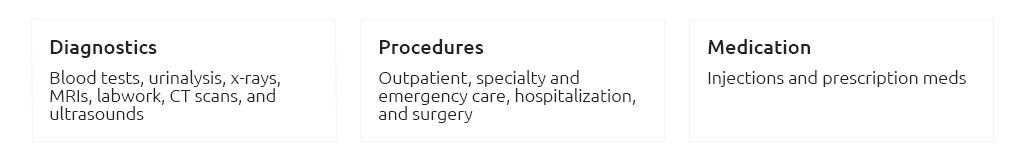

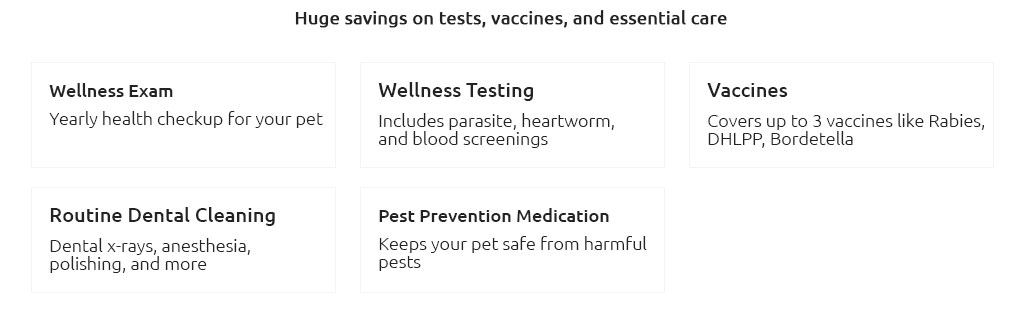

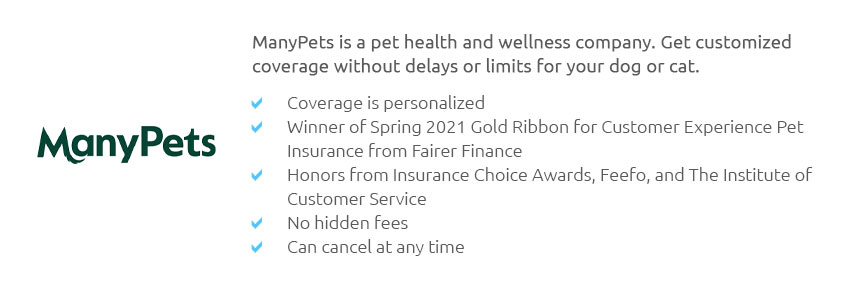

Understanding the Nuances of Multiple Cat Insurance: A Comprehensive GuideOwning multiple cats can be an immensely rewarding experience, yet it comes with its own set of challenges, not least of which is managing their health care. This is where multiple cat insurance becomes a significant consideration for pet owners who aim to provide the best possible care for their feline companions without breaking the bank. In this article, we delve into the intricacies of insuring more than one cat, offering insights and practical advice that could ease the decision-making process for pet owners. The concept of insuring multiple cats under a single policy is gaining traction, largely because of the potential cost savings and the convenience it offers. Just as humans benefit from family health insurance plans, cats too can be covered collectively, which often results in lower premiums compared to insuring each cat separately. This approach not only simplifies billing but also consolidates policy management, making it easier for owners to keep track of coverage details. However, while cost efficiency is a compelling advantage, it is essential to delve deeper into what these policies typically cover and the limitations they might impose. Most multi-cat insurance plans offer a range of coverage options, from basic accident coverage to more comprehensive plans that include illnesses, surgeries, and even preventive care like vaccinations and routine check-ups. Some insurers might also provide additional benefits such as dental care, behavioral therapy, and alternative treatments like acupuncture, which are becoming increasingly popular among pet owners. The key is to assess the specific needs of your cats-considering factors such as age, breed, and pre-existing health conditions-before selecting a policy. This tailored approach ensures that you are not paying for unnecessary coverage while ensuring your cats have the protection they need. It's worth noting, however, that not all insurance providers are created equal, and the terms of multi-cat policies can vary significantly. Before committing to a plan, it is crucial to thoroughly read the fine print and ask pertinent questions. For instance, inquire about exclusions, which are common in pet insurance policies. Some plans might not cover hereditary conditions or might impose waiting periods before coverage kicks in. Additionally, check if there are any caps on payouts per incident or annually, as these can impact your out-of-pocket expenses significantly in the event of a major health issue. Another factor to consider is the flexibility of the plan. Some insurers allow you to add or remove pets from your policy as needed, which is particularly useful if you anticipate changes in your feline family. Furthermore, look for insurers that offer a multi-pet discount, as this can further enhance the cost-effectiveness of the insurance. Comparing quotes from different providers is always a wise strategy, as it gives you a clearer picture of the available options and the market rates. In conclusion, while the prospect of insuring multiple cats might initially seem daunting, approaching it with a clear understanding of your needs and the available options can lead to a satisfactory outcome. Investing in a well-rounded insurance plan not only provides peace of mind but also ensures that your furry friends receive the best possible care when they need it most. As with any financial commitment, a careful evaluation of the policy details and a comparison of different offerings are crucial steps that can lead to significant long-term benefits. Ultimately, the goal is to find a balance between comprehensive coverage and affordability, ensuring that your beloved cats lead healthy, happy lives. https://www.everypaw.com/multi-pet-insurance

Everypaw has a range of Lifetime cover available for cats, dogs and rabbits galore. We've laid down a little multi-pet insurance comparison table so you can ... https://spotpet.com/insurance-for-multiple-pets

Pet insurance plans that offer multi-pet discounts can be a good way to help you save money on premium costs and get reimbursed for covered vet bills. https://www.felixcatinsurance.com/why-felix/

With Felix Cat Insurance, you can receive a 5% discount when you enroll more than one cat on your policy. We're Cat Specialists. and our expert cat insurance ...

|